In this 2-part series, we will be talking about some of the common money mistakes many of us commit at some point of time.

#1: Investing without having financial goals

When you invest without having any specific goals & timelines to achieve that, you are very likely to not stay the course and exit early, thus leading to your money not reaping the benefit of compounded returns.

On the other hand, when you are aware that this investment is for XYZ Goal (could be children’s education, starting your own venture, building your retirement corpus etc), you are more likely to be invested in this process till you hit that goal, and not be distracted.

So, follow the process of goal based investing for long term wealth generation.

#2: Investing in assets just out of FOMO

How your hard earned money goes into various asset classes (asset allocation) should be a function of – your short term & long term financial goals, time horizon & your risk appetite.

What often distracts us is – the shiny new asset class, where your colleague, boss, friend, classmate, cousin, ex (& perhaps his/ her dog too!), seem to be laughing all the way to the bank. Its all over social media, with seemingly endless success stories making you feel a bit stupid for not being part of it.

That asset class could be – crypto, options trading, buying a piece of land etc.

DON’T FALL for the trap, unless until you have very deep understanding of that asset class. You never know when the tide will turn, and you will be left holding something absolutely worthless.

If you’re the kind who can’t resist that urge to jump in, limit your exposure to max 5-10% of your investments to cap your downside risks.

#3: Looking at absolute returns and not annualized returns

Say, you invested Rs 10,000 in XYZ mutual fund 2 years back & that amount has nicely grown to Rs 18,000.

What’s the return on your investment?

80%, right?

No, that’s the absolute return over those 2 years. The true representative return would be the annualized returns, which in this case turns out to be 34.2% by using the compound interest formula

A = P *(1+r/100)^n

Its only with annualized returns you can do an apple-to-apple comparison of your investment with its peer set or the benchmark index.

Many dashboards, including the online statement you see on many investing Apps or mutual fund investing websites, show you absolute returns. Don’t go by that, instead look at annualized returns.

#4: Don’t put all your eggs in one basket.

Perhaps one of the biggest cliches in the world of personal finance, yet so relevant.

Sharing an interaction I had recently with an IT professional in his late 50s, who’s looking to hang up his boots in next couple of years.

The gentleman proudly disclosed the financial plans he has put together for his retirement. In a gist, more than 80% of his assets were in real estate – 2 flats (other than his self occupied one) & a piece of land in his hometown.

He’s put almost all his lifelong earnings in just 1 asset class – that too, which is known to be relatively illiquid, where the up & down cycles can be particularly long & has delivered returns lower than the stock market broader indices.

As against this, a well-diversified portfolio means holding a basket of different assets, in a manner that your risks get spread out so that even if one of the asset classes is giving lower returns, it is compensated by higher returns from another asset class in your portfolio.

#5: Not starting to invest early

Many people make the mistake of not starting their investments early in life, with a common reason being they will do so only once they start saving “BIG AMOUNT”.

Little do they realize that the power of COMPOUNDING works its magic only if you give more time to your investments.

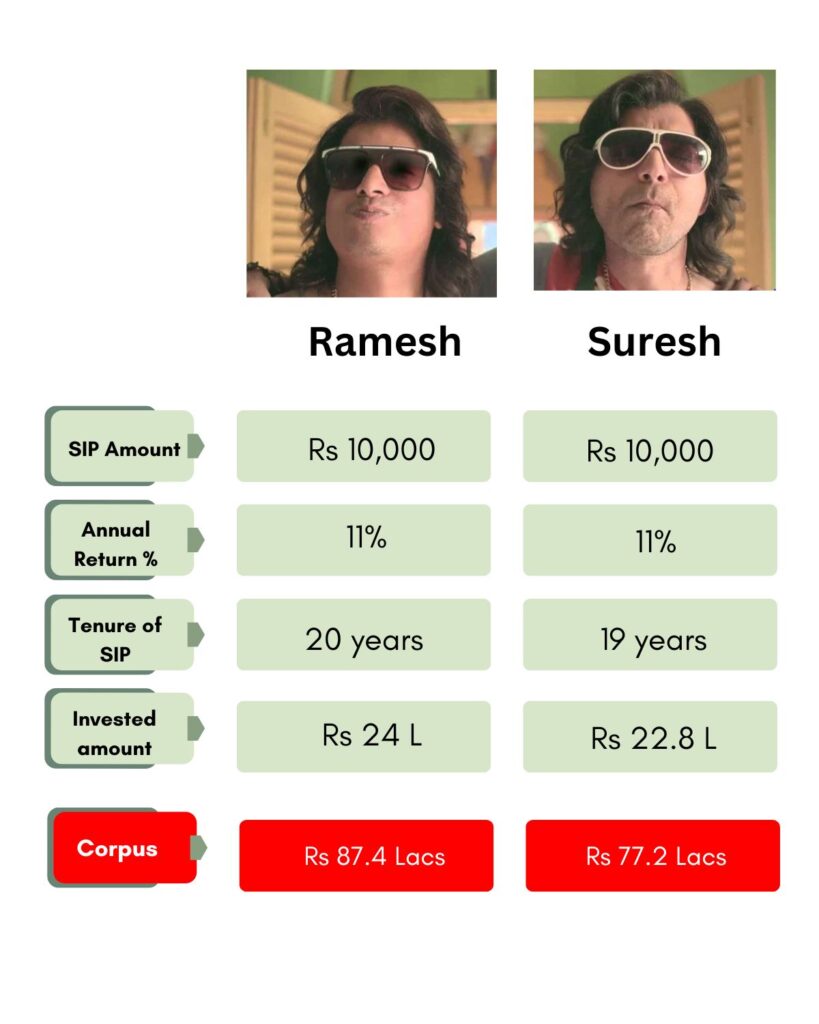

Or in other words, even SMALL amounts when invested for loooong, become BIG. Just a 1-year delay in starting an SIP of just Rs 10,000 can make a difference of a whopping Rs 10 lakhs in corpus at the end of 20 years.

The other payoff of starting EARLY – saving is a habit and the more you start developing this muscle early on, the better your financial health later in life.

Start NOW.

#6: Following someone’s advice blindly

There are enough people ready to provide pearls of wisdom on where to invest our money & which insurance plan we ought to buy.

And it makes our life so easy by just following that advice.

However, that’s a recipe for disaster, even though we see this playing out in virtually every household.

Why?

Your friend/ relative is not aware of your CONTEXT – what are your financial goals? What is your risk appetite? What’s your time horizon?

He may not even be qualified to offer you advice & his advice may be based just on his own experience.

What’s good for him, may not be good for you.

Would you take the risk of following another patient’s prescription for your illness?

Remember the importance of PERSONAL in personal finance.

#7: Expecting to get thrill out of investing process

Most of us live a pretty mundane existence, doing the same boring work for a living, running household errands over the weekend…And the story repeats week after week.

I have seen this expectation from some folks – that investing will give them some thrill/ / kick & fill in that void for excitement in life.

However, good investing is very boring – it requires discipline, lot of patience, far sightedness & long periods of “doing nothing” (of course, other than continuing your SIPs!).

All of the above are anti thesis to thrill & excitement.

Actually, if you have started to get some thrill out of your investments, you probably are doing something wrong.

#8: Not factoring in the impact of inflation

Our minds are conditioned to interpret money in TODAY’S terms.

So, while Rs 1 cr seems a big amount today, its equivalent value after 10 years will be what Rs 51 lacs is worth today (assuming 7% inflation). And in 20 years, it will be Rs 26 lacs.

But why I am talking about this?

So that, everyone has the mental calculator of inflation ON while taking money decisions.

Practical applications:

- Insurance coverage: keep in mind the insured amount not from today’s lens, but over the entire period (10/20/30 yrs..) for which you are taking coverage.

- Future goals – an MBA program that costs Rs 25 lakh today could be as high as Rs 1.68 cr 20 years from now (assuming reasonable inflation of 10% in fees)

- FIRE / normal retirement planning – keep in mind that the household expenses will adjust every year for inflation, irrespective of whether we are working or not.

Didn’t somebody say – inflation is an invisible tax?

Hope you could resonate with some of these. If you think anyone you know will find this useful, do share this with them.

Click here for Part 2 of the common money mistakes many of us commit.